What is Identity Fraud?

Identity fraud has emerged as a significant concern with the constant evolution of technology, the internet, and how we interact. It’s crucial to have explicit knowledge about what it is, how to recognize it, and, most importantly, how to protect yourself.

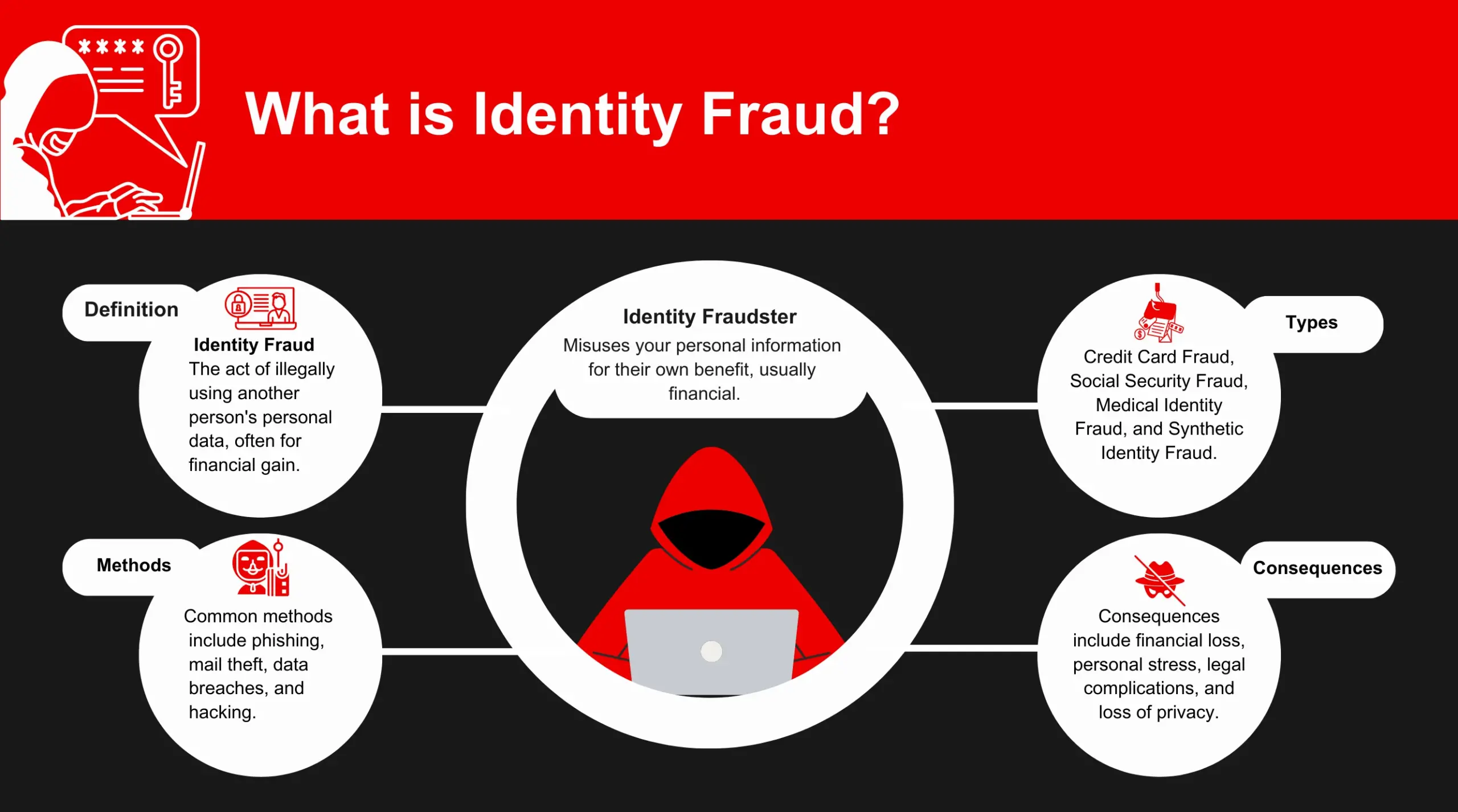

It’s when someone else gets your details, like your Social Security number, credit card details, or medical information, and uses it for their benefit, typically for financial gain. It’s a violation of your privacy and trust.

There are different ways someone can get a hold of your information. This could be stealing your mail or rummaging through your trash for discarded bills or receipts. On the internet, it might be through phishing emails (where you’re tricked into providing your details), data breaches (where the information you’ve provided to a company gets leaked), or outright hacking.

There are several types of identity fraud that you should be aware of. For instance, someone might use your credit card details to make purchases (Credit Card Fraud), use your Social Security number to apply for loans (Social Security Fraud), use your insurance details to receive medical care (Medical Identity Fraud), or combine real and fake information to create a new identity (Synthetic Identity Fraud).

It’s not just about losing money – that’s a big part. Identity fraud can lead to stress as you work to regain control of your details. You might have to spend hours on the phone, filling out forms, or even in court. Potential legal issues exist if your identity is used for illegal activities.

Now that we know what identity fraud is, how do we recognize it? Often, the first sign comes from your financial statements. If you see charges you don’t remember, accounts you didn’t open, or loans you didn’t apply for, that’s a big red flag.

Financial institutions and credit bureaus also monitor for signs of fraud. They may contact you if they see suspicious activities, like lots of charges in a short time, significant transactions, or applications for credit in your name. Another warning sign is receiving emails or phone calls asking for personal information.

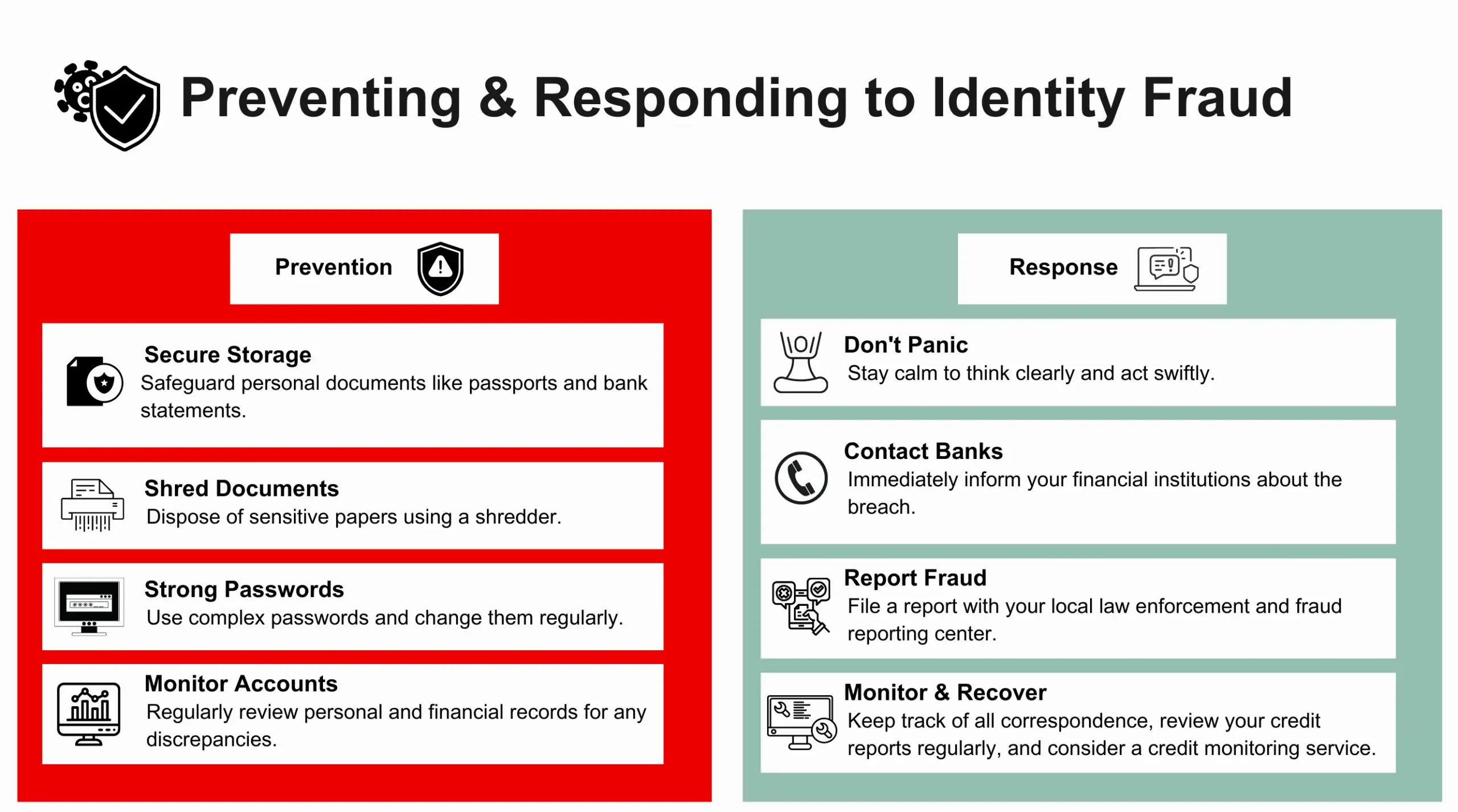

Now for the part, we’ve all been waiting for: how do we stop identity fraud? It all starts with how we handle our personal information. Make sure you store your documents, like your Social Security card, passport, and bank statements, in a secure place. When you need to throw away records with sensitive information, don’t just toss them in the bin – shred them first.

Make sure you’re using strong passwords, and change them regularly. Be extra careful when using public Wi-Fi networks, as they might not be secure, and only give out your personal information if you’re sure it’s a trusted source.

Reviewing your financial and personal records can also help you spot any irregularities. If you see something that doesn’t look right, don’t ignore it – investigate. It’s also worth getting regular credit reports to see if you need to recognize any accounts or inquiries.

So, you’ve spotted some signs of identity fraud – what do you do now? First of all, don’t panic. There are steps you can take to limit the damage and regain control.

Immediately contact your bank or credit card company to let them know. They can close your accounts or freeze your cards to prevent further transactions. Then, report it to the police and file a report with your national or regional fraud reporting center.

Cleaning up after identity fraud can take time and patience. Keep a record of all your conversations and correspondence, regularly check your accounts and credit reports for any further signs of fraud, and consider getting a credit monitoring service.

It’s not just individuals who have a role in preventing identity fraud. Governments worldwide have set data protection laws and regulations to protect individuals’ personal information. They also offer resources and support for victims of identity fraud.

Technology companies are also doing their part. They’re constantly working on new security measures to protect users’ information. This includes two-factor authentication (where you need two forms of ID to log in), encryption (which makes your data unreadable to anyone without a unique key), and AI systems that detect unusual activity.

Understanding and protecting yourself against identity fraud is crucial; it’s not just about keeping your money safe – it’s about safeguarding your personal information and peace of mind. By being informed, staying vigilant, and taking steps to protect yourself, you’re well on your way to securing your identity.